Changes in the Structure of Local Budgets During the War: Challenges, Trends, and Strategy to 2027

The economy of Ukraine has experienced significant shocks since the full-scale invasion of the Russian Federation in February 2022. According to the latest estimate, prepared in cooperation with the UN, as of December 31, 2024, the total cost of reconstruction and recovery in Ukraine over the next decade will be 524 billion US dollars, which is approximately 2.8 times higher than the nominal GDP of Ukraine in 2024.[1]

All regions of Ukraine, especially those close to the borders with the Russian Federation – Donetsk, Luhansk, Kharkiv, Sumy, Zhytomyr, Kyiv, Chernihiv, Kherson and Zaporizhia regions – experienced difficulties in the functioning of the economy. The economic downturn in 2022 led to a reduction in business activity, which negatively affected tax revenues. Small and medium-sized businesses, which are the basis of local budgets, found themselves in a crisis situation due to the destruction of infrastructure, reduced production and population outflow. As a result, communities began to receive less taxes, which significantly increased their dependence on state subsidies and subventions.

In 2023, the economy began to gradually adapt to difficult conditions, which allowed communities to meet their expenses to some extent. However, the pace of recovery was insufficient to obtain pre-war income levels. Even in regions where business began to pick up, there was a shortage of financial resources due to the general uncertainty of the economic situation.

Inflation became another key factor affecting the budget filling of communities. Rising prices contributed to an increase in nominal tax revenues, especially from personal income tax and excise duty. However, this effect was heterogeneous: although community budgets received more funds in hryvnia equivalent, their real purchasing power decreased significantly. Rising inflation also caused an increase in the price of goods and services financed from local budgets. This meant that, despite the nominal growth in revenues, the actual capabilities of communities to finance social programs and utilities decreased.

The new level of inflation was a factor in the growth of wages, which automatically increased personal income tax revenues. At the same time, it also caused an increase in expenditures on the remuneration of budget employees, which required adjustments to local budgets. Some communities were able to adapt to inflationary processes by attracting additional financial resources, including grants, international donor support and local loans. At the same time, in most regions, there was a need to increase intergovernmental transfers due to the lack of own revenues.

Exchange rate instability, caused by both inflationary processes and the general state of the national economy, affected the level of the budget deficit. Due to the devaluation of the hryvnia, costs for imported goods increased, which further complicated the implementation of local budgets. Thus, if the official exchange rate of the hryvnia to the US dollar at the beginning of February 2022 was UAH 29.25, then in February 2025 it increased to UAH 43.49 per US dollar.

Thus, the deterioration of the economic situation in 2022, caused by the war, became the main factor in reducing budget revenues, and the gradual recovery in 2023–2024 could not fully compensate for these losses. The main challenge for communities remains the search for new sources of budget funding, adaptation to macroeconomic changes, and effective management of financial resources in conditions of high inflation and an unstable economic environment.

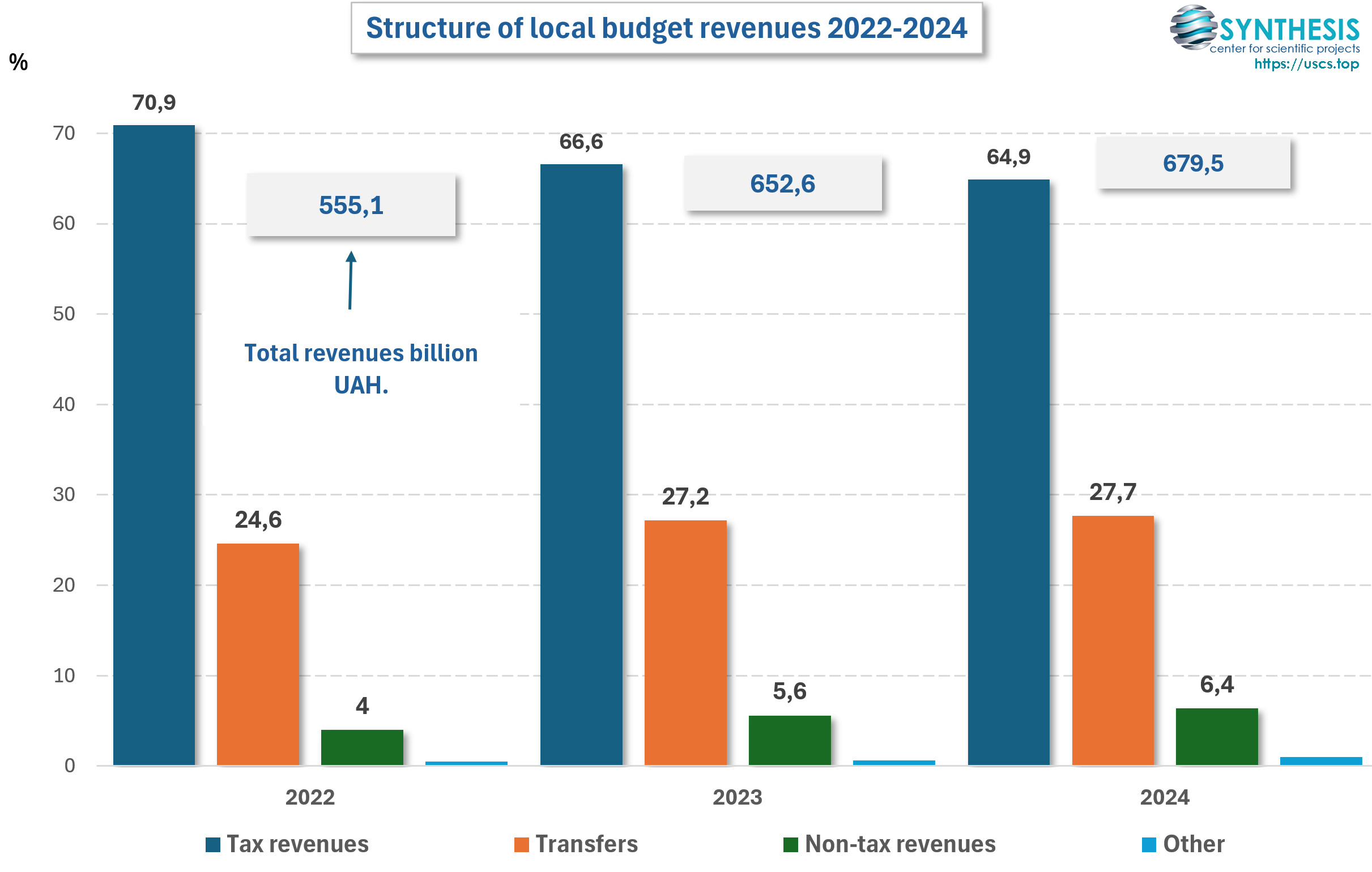

In the structure of local budget revenues, taxes have the largest share. In 2022, according to data from the Ministry of Finance of Ukraine, this figure was 70.9%, and transfers – 24.6%.[2]

Despite the fact that in 2023 the share of taxes decreased, in absolute terms their volume increased from 393.5 billion UAH in 2022 to 434.5 billion UAH in 2023. Budget transfers during this period also increased from 136.8 billion UAH in 2022 to 177.4 billion UAH in 2023. This was to some extent reflected in the budget structure (an increase in the share of transfers from 24.6 to 27.2 percent). In 2024, the volume of taxes increased to 441.1 billion UAH, and their share decreased to 64.9%.

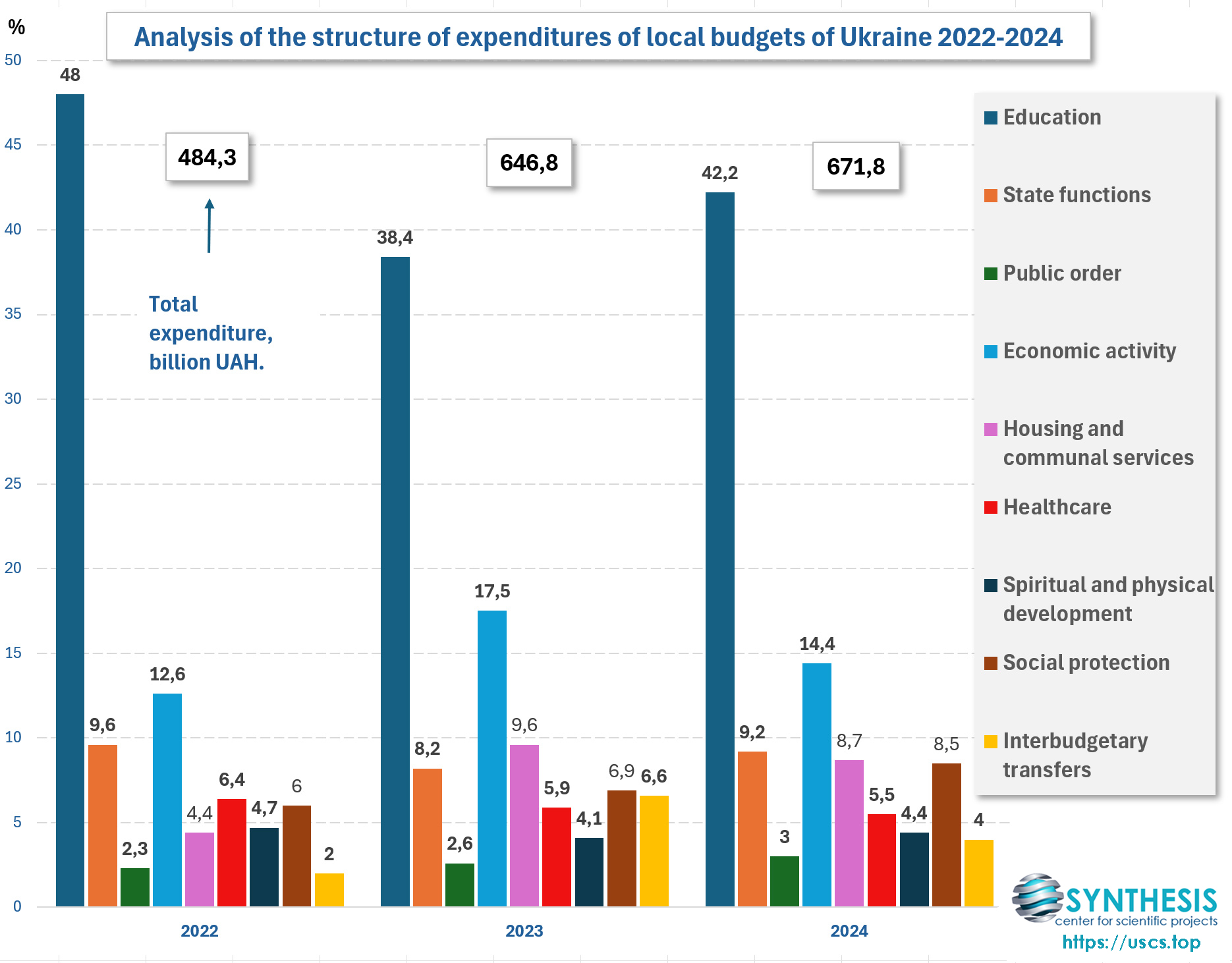

From the revenues received, local authorities made a wide range of expenditures.[3] However, in 2022 and 2023, local budgets recorded a significant surplus. Among the reasons for the surplus was the level of implementation of planned indicators for local budget revenues and expenditures. Also in favor of the surplus was the personal income tax, in which the salaries of military personnel accounted for a significant share.

An assessment of the structure of local budget expenditures indicates a significant role of education expenditures. In 2022, the share of taxes was 48.0 percent, the absolute volume was UAH 232.3 billion. Education expenditures are one of the largest items of local budgets. They are aimed at ensuring the activities of educational institutions, developing educational infrastructure, improving the quality of education and social support for students and teachers. A separate and important source of education financing is the educational subvention – an inter-budgetary transfer from the state budget, which is directed to local government budgets.

An educational subvention is funds that the state transfers to communities to ensure the financing of secondary education. Among the main areas of financing at the expense of this subvention are:

– salaries of teaching staff in schools (excluding technical staff).

– allowances, bonuses, incentive payments for teachers (for prestige, seniority, additional workload).

– payment for educational materials and methodological support for secondary education institutions.

– financing of inclusive education, in particular, payment of teacher assistants for children with special educational needs.

– expenses for advanced training of teachers, courses, certification.

At the same time, this subvention does not cover expenses for utilities, food, repairs or transportation – these expenses are financed by communities from their own resources.

For the functioning of this sphere, the community pays expenses for financing preschool, after-school, special education (maintenance of kindergartens, sports and art schools). It also pays salaries of non-teaching staff (technical workers, administration, security), utilities, purchases of educational materials, school furniture and other property. Communities also pay for the organization of meals in schools, preferential travel and school transport (this is especially important for rural areas), providing scholarships and social assistance to children from low-income families, material support for teachers, teacher training courses (can be financed both from local budgets and at the expense of educational subventions), implementation of innovative programs (STEM education, digitalization of the educational process) and other areas.

A prominent place in the budget of the territorial community is occupied by expenditures for economic activity. The main areas of expenditures for economic activity in local budgets are the implementation of measures within the framework of budget programs related to the financing of municipal transport, transport infrastructure, agriculture, the fuel and energy complex, communications, communications, construction, as well as other components of the economic and economic sphere. The effective use of these funds is the key to the sustainable development of the community and improving the quality of life of its residents. In 2023, the share of expenditures for the economic sphere increased significantly compared to the previous year and amounted to 17.5% of the total volume of expenditures of UAH 646.8 billion. According to this indicator, the complex of issues on the development of the economic sphere was second only to expenditures for education and significantly exceeded the volume of expenditures for the housing and communal services sector. The main direction of supporting the housing and communal services sector is the maintenance and development of communal infrastructure, including the repair, modernization and operation of water supply and heating systems.

It is quite clear that in the conditions of full-scale aggression, expenditures on this sphere, which has probably suffered the most, will grow. The volume of expenditures of local communities in 2020 amounted to 32.1 billion UAH, while in 2024 this figure increased to 58.6 billion UAH. After the end of the war, the restoration and repair of the housing stock and financing of energy saving measures will be of great importance for communities. In general, over the three-year period of the war with the Russian Federation, we can outline the following general trends in budget policy at the regional and state levels. Defense spending in 2022 increased by 796.4% compared to 2021. Of course, this affected some important areas of state policy. For example, spending on education decreased by 8.3% in the state budget and by 6.7% in local budget expenditures. In local budgets, healthcare expenditures also decreased during this period – the decrease in funding is estimated at 6.3%.

Local budgets increased their contribution to financing social protection issues. At the same time, at the state budget level, expenditures on budget programs that provide payments of subsidies from the local budget have increased significantly. This will also be noticeable in 2025. For example, in budget programs for providing subventions to local budgets, for which the Ministry of Veterans Affairs of Ukraine is responsible.

In the area of support and development of the housing and economic sector, the financial burden falls more heavily on the local budget. At the same time, the state budget began to make larger contributions. If in 2021 the share of expenditures from the local budget in the consolidated budget was 99.6%, then in 2024 this figure decreased to 88.7%.

What does Ukraine plan for the future? The government has adopted a regional development strategy that will be in effect until 2027.[4]

The main areas of further action are – creating conditions for ensuring the safety of life, restoring and stimulating economic activity in the regions, attracting investments, including the resources of international financial organizations. Also important elements of regional policy will be measures for economic and social adaptation, as well as the rehabilitation of citizens in the deoccupied territories. The central and local authorities will pay significant attention to the system of public administration, which is responsible for providing the population with high-quality administrative and public services, especially in the territories that were under Russian occupation.

© Kostiantyn Kuznietsov 2025

© Synthesis 2025

[1] https://www.undp.org/uk/ukraine/press-releases/onovlena-otsinka-zbytkiv-svidchyt-pro-potrebu-u-524-milyardy-dolariv-dlya-vidnovlennya-ukrayiny-protyahom-nastupnoho

[2] https://mof.gov.ua/uk/

[3] https://mof.gov.ua/uk/

[4] https://zakon.rada.gov.ua/laws/show/940-2024-%D0%BF#Text