Post-War Reconstruction: A Roadmap for Resilience

The Success of Germany’s Reconstruction Model: Lessons for Ukraine’s Recovery

War always leaves behind profound economic and social upheavals, altering not only the economic structure of a country but also the very approaches to managing financial resources. For Ukraine, which has suffered large-scale destruction due to military aggression, the issue of recovery is not just relevant but vital. The financial and economic challenges caused by the war create unprecedented pressure on the state budget, financial management system, and economic resilience of communities. Under these conditions, it is important to find a balance between the urgent needs of wartime and the strategic priorities of long-term recovery.

Global experience shows that successful post-war reconstruction is possible through an effective combination of state and market mechanisms, targeted and long-term external support, and well-balanced financial policies. One of the most well-known examples of large-scale economic recovery is Germany’s post-war reconstruction, which, thanks to comprehensive reforms, international assistance, and modernization, managed not only to overcome the consequences of destruction but also to create the foundation for long-term economic prosperity.

Studying this experience is particularly valuable for Ukraine, which today faces similar challenges. The success of post-war recovery depends not only on financial resources but also on how they are used, what structural reforms are implemented, and how the reconstruction process integrates into the overall economic transformation. In this context, it is important to assess the mechanisms that contributed to Germany’s economic growth and determine which of them can be adapted to modern Ukrainian realities.

This article outlines the key financial and economic consequences of war for Ukraine and analyzes the experience of Germany’s post-war recovery. The main goal is to determine which tools and approaches can serve as the foundation for an effective model of Ukraine’s reconstruction, taking into account both economic and social aspects of sustainable development.

Financial and Economic Consequences of Military Aggression for Ukraine

The full-scale military aggression by the Russian Federation has led to significant financial and economic challenges for Ukraine. In 2022, Ukraine’s economy contracted by 29.1%, marking the most severe annual decline in its history of independence.[1] The negative factors include the partial occupation of certain territories, disruption of logistics, large-scale population displacement, decreased consumer demand, and a decline in export volumes. According to estimates by the World Bank, the European Commission, and the United Nations, as of December 31, 2023, the total cost of reconstruction and recovery in Ukraine is projected to reach $486 billion over the next decade.[2]

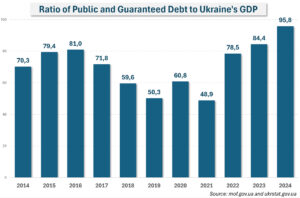

The war has severely impacted the public finance system, leading to a drop in state revenues, a significant budget deficit, and a sharp increase in public debt. While the debt-to-GDP ratio following the COVID-19 economic crisis in 2020 was 60.8%, by 2023, this figure had risen to 84.4%.[3] According to preliminary calculations by the National Bank of Ukraine, the nominal GDP for 2024 is expected to be 6,692.4 billion UAH. Given the estimated public debt for the same year, the debt-to-GDP ratio is projected to reach 95.8%.

In the 2025 state budget, the cost of servicing public debt is planned at 480.8 billion UAH, significantly exceeding expenditures on other budget programs. For example, the total budget for the Ministry of Culture and Strategic Communications is 11.3 billion UAH, while the Ministry of Youth and Sports of Ukraine is allocated 5.8 billion UAH.[4]

Such challenges put the entire financial system of Ukraine to the test-from the national to the local level. In this context, the financial capacity of territorial communities becomes particularly important, as it will determine their ability to recover and contribute to economic development. Local budgets remain highly dependent on the state budget-by the end of 2024, transfers from the central budget in the form of grants and subsidies accounted for approximately 28% of local revenues.[5] The largest financial support from the central government is allocated to education, while additional funds are directed toward addressing the consequences of military aggression and implementing recovery projects.

Overcoming the consequences of war requires a comprehensive approach, including enhancing security, strengthening economic resilience, and improving governance efficiency. It is essential to focus on key areas of community development. First and foremost, establishing efficient social, industrial, and transportation infrastructure is crucial to ensure the stable functioning of the economy and improve the quality of life for citizens. Another critical factor is the balanced use of natural resources, which will enable sustainable development in the long term.

Since the beginning of the aggression, Ukraine’s critical infrastructure has been a primary target of missile attacks, resulting in the loss of significant energy generation capacity. Additionally, Russia’s full-scale invasion and genocidal warfare have caused severe demographic challenges, including: mass internal displacement, leading to overpopulation in relatively safer regions; large-scale forced emigration, primarily among women and children; Increased mortality rates, ultimately contributing to population decline and labor shortages.

In this context, Ukraine’s international partners play a crucial role in state financing. From the start of full-scale aggression until January 2025, foreign governments and international organizations provided $118.3 billion in financial aid to Ukraine’s state budget.[6] The largest contributions came from: European Union – $47.9 billion; United States – $31.2 billion; IMF – $12.4 billion; Japan – $8.5 billion; Canada – $5.4 billion; World Bank – $5.3 billion; United Kingdom – $3.0 billion; Germany – $1.7 billion.[7]

Under martial law and during the subsequent recovery period, the primary objectives remain ensuring defense capabilities, providing social support to the population, and rebuilding critical infrastructure. Another pressing issue is demining. Mined lands pose a serious threat to human life and make agricultural activities impossible, which is crucial for Ukraine’s economy. Addressing these challenges requires substantial financial resources, making international support essential for Ukraine’s fiscal system.

To accelerate the recovery process, entrepreneurial activity must be systematically supported. Local businesses play a vital role in job creation, local budget revenues, and ensuring regional economic self-sufficiency. Government policies should be aimed at supporting small and medium-sized enterprises (SMEs), attracting investments, and creating a favorable business climate.

To achieve long-term recovery goals, Ukraine must develop strategic socio-economic development plans that outline clear priorities and implementation mechanisms. Special attention should be given to efficient use of financial resources, ensuring optimal budget allocation and securing additional funding sources.

The assessment of the effectiveness of community regeneration programs and projects should be based on criteria such as territorial coverage and the number of people who will benefit from the project, its compliance with strategic development goals, the level of innovation, co-financing mechanisms, the financial capacity of the community, and socio-economic significance. The source of financing remains an important factor – the use of state and local budget funds does not create an additional debt burden on communities in the medium and long term. A critical factor remains the source of funding-using state and local budget funds ensures that communities do not face additional debt burdens in the medium and long term.

Large-scale recovery efforts necessitate a transparent monitoring and evaluation system, allowing for the measurement of outcomes. Such an approach will enhance transparency and efficiency in public and local expenditures.

Financial and economic challenges of war and Germany’s experience for the restoration of Ukraine

Ukraine must study the experiences of different countries that have undergone difficult recovery periods after large-scale destruction due to military conflicts. After Germany’s surrender in May 1945, the country’s economy was in a critical state. Due to bombing, Germany’s infrastructure was almost completely destroyed-railway hubs, stations, and depots were in ruins, the energy system was not functioning, which complicated industrial recovery. At the same time, water supply and sewage systems in cities were partially or completely destroyed, leading to outbreaks of infectious diseases. The lack of fuel caused the collapse of transport, making it impossible to transport food and coal.

Germany’s recovery was part of a large assistance plan for European countries, in which the United States played a key role. This economic aid program is widely known as the Marshall Plan. At that time, George Marshall held the position of U.S. Secretary of State, and during his speech on June 5, 1947, at Harvard University, he outlined the idea of Europe’s recovery. Assistance was also offered to the USSR, but Stalin rejected it.

At the first stage, there was a proposal to turn Germany into an agrarian country, which implied complete deindustrialization, but later this approach was changed. Between 1948 and 1951, West Germany received $1.297 billion within the framework of the European Recovery Program (ERP).[8]

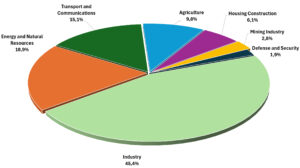

The distribution of aid across Germany’s economic sectors, aimed at ensuring the rapid recovery of Germany’s industrial potential, provided the greatest support and development in the following areas: industry – 46% (143 large industrial projects); energy and natural resources – 19% (supply of coal and oil, development of hydroelectric power plants, modernization of electrical grids); transport and communications – 15% (restoration of railways, bridges, roads, and ports, procurement of new railway locomotives and wagons to support logistics routes); agriculture – 10% (mechanization of farms and agricultural production, procurement of fertilizers, agricultural machinery, and seeds); housing construction – 6% (financing housing programs for displaced persons and workers, creation of new housing stock); mining industry – 3%; defense and security – 2%.

Germany’s public finance system faced a significant budget deficit. For example, in 1948, the budget deficit-to-GDP ratio was 20%. To stabilize the situation, foreign exchange reserves were used, and additional loans were provided. As a result of such measures, by 1952, the deficit decreased to 9% of GDP.

Four elements of Germany’s recovery system contributed to its success:

- Capital investment and industrial modernization. A significant amount of funds was directed toward critically important sectors: metallurgy, mechanical engineering, and the chemical industry. To increase productivity, projects involving advanced technologies and automation were introduced, stimulating production and competitiveness.

- Under U.S. pressure, cartels were dismantled and monopolies were restricted. The German government reduced tax pressure on the private sector and created conditions for investment.

Institutional changes allowed market mechanisms to operate more efficiently, contributing to convergence with economically developed countries.

- Changes in the employment structure and increased labor productivity

The shift of the workforce from agriculture to industry increased the share of those employed in industry and the service sector (urbanization).

Investments in vocational education and workforce training led to the development of technical and higher education systems, which improved the qualifications of workers.

By the 1950s, West Germany’s labor productivity reached the level of the United Kingdom.

- Export-oriented economic model and integration into global markets

Germany created conditions for exporting industrial goods, ensuring a steady inflow of foreign currency and stimulating industrial development.

In the future, West Germany became one of the founders of the European Coal and Steel Community (1951), which contributed to economic cooperation and successful dynamic growth.

Conclusions

Ukraine’s recovery requires a comprehensive approach that takes into account the best international practices. West Germany’s experience shows that successful recovery is possible with large-scale financial support, economic modernization, and structural reforms.

For Ukraine, effective use of external financial assistance is critically important, directing it toward the restoration of critical infrastructure, industry, and energy systems. At the same time, economic liberalization and the creation of favorable conditions for investment and entrepreneurship should become priorities of state policy.

Overcoming budget deficits requires rational financial management and strengthening local budgets, ensuring the stability of the economic system. A key component is an export-oriented strategy and integration into global markets, which will attract foreign exchange earnings and stimulate economic growth.

Such a strategy should ensure a combination of state regulation and market mechanisms, stimulate innovation, and support a proper business climate. The successful application of these principles will allow Ukraine to build a national economy that is resilient to challenges and capable of rapid development.

[1] https://bank.gov.ua/ua/news/all/komentar-natsionalnogo-banku-schodo-zmini-realnogo-vvp-u-2022-rotsi

[2]https://documents1.worldbank.org/curated/en/099021324115085807/pdf/P1801741bea12c012189ca16d95d8c2556a.pdf

[3] https://mof.gov.ua/uk/derzhavnij-borg-ta-garantovanij-derzhavju-borg

[4] https://zakon.rada.gov.ua/laws/show/4059-20#Text

[5] https://mof.gov.ua

[6] https://mof.gov.ua/uk/

[7] https://mof.gov.ua/uk/news/ukraines_state_budget_financing_since_the_beginning_of_the_full-scale_war-3435

[8] https://www.oecd.org/content/dam/oecd/en/publications/reports/2008/09/the-marshall-plan_g1gh8e35/9789264044258-en.pdf